According to the latest research from the National Venture Capital Association (NVCA 2012), venture capital is responsible for roughly 12 million jobs and $3 trillion in revenue in the United States and accounts for 21 percent of its gross domestic product and 11 percent of its private sector employment. In 2010 alone, venture capitalists invested approximately $22 billion into more than 2,700 companies, 1,001 of which received funding for the first time.

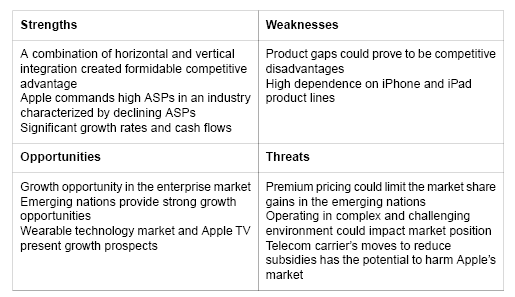

For those who know the term “venture capital” but aren’t entirely sure what it entails, venture capital firms (there are about 460 of them in the United States) raise funds from large, institutional-type investors–think pension funds, endowments and the like–and invest that money in new companies or ideas they believe will become commercially successful. The goal is to have the start-up companies either go public (i.e., sell shares of their stock to the public) or be acquired (bought) by another company so that the venture capital (VC) firm can pay back the institutional investors who provided the “seed” money and also make a little profit for themselves.

Given the unpredictability of the business world, it’s no surprise that these investments are essentially high-stakes gambles by VC firms. The NVCA estimates that 40 percent of companies that receive venture capital fail, and a similar share produce only “moderate” returns (NVCA 2012). Only about one in every five investments produces significant profits, and it is these returns that make it possible for the venture capital industry to consistently perform better than the public markets.

While making money is certainly important to venture capitalists, the highest ideal in this particular industry is to drive job creation, economic growth and technological advancement by giving a “leg up” to entrepreneurs and helping them turn their bright ideas into products and services that influence our everyday lives. Since 1970, VC firms have invested more than $450 billion in 27,000-plus start-up companies (NVCA 2011), the most famous of which include Google, Microsoft, FedEx, Apple, eBay, Intel and Facebook.

Researching the Deal

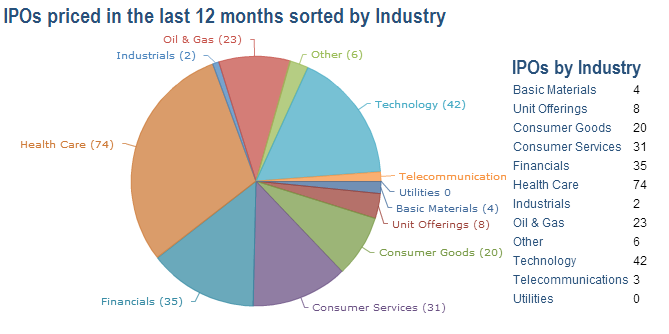

So, where do librarians fit into all of this? Well, given that the average venture capital investment is around $7 or $8 million (though investments of $30 to $50 million are not uncommon), venture capitalists don’t just throw their money at every start-up idea that happens to walk in the door. Vetting, or “due diligence,” is crucial to the success of a VC firm. And while it is best to let those with investing experience pore over the financial statements, the research skills required to sort through the various markets, companies, technologies, regulatory issues and individuals related to a potential deal are perfectly suited to the modern information professional.

I should know–I am a research analyst for a top-ranked VC firm in Texas. I don’t have a business degree, but I do have a library degree, not to mention a passion for competitive intelligence and a time-honed knack for unearthing the kind of deeply buried information–especially information about private companies, which tends to live under the radar if it lives anywhere at all–that is invaluable to a venture capitalist. And although the world of investing was outside my comfort zone coming into this job (my background is in library science and journalism), I’ve also learned more than I ever imagined about the ins and outs of successful companies and investments. These days, I can even look at a balance sheet and make some sense of it.

At my firm, I work with another MLIS-degreed research analyst to provide research support to roughly 25 investment professionals. We also offer services to the companies in our portfolio and to our “CEOs in residence” (my firm partners with proven, entrepreneurial CEOs to pursue value creation opportunities in segments of mutual interest), as well as to entities or individuals closely related to the firm. Essentially, we act as reference librarians to the firm and its extended family, with the key difference being that we tend to simply provide the information they are seeking rather than showing them how to find it themselves. In addition, we perform a good deal of synthesis on the data we dig up, both to help clients make more sense of it and to more quickly point them in the direction of an answer.

Inquiries typically come to us through e-mail, though some are made in person or presented over the phone. The next step is often a reply that can take the form of everything from a brief narrative to relevant data points to a selection of materials related to the query subject. Sometimes the other research analyst and I will have the opportunity to use the reference interview skills we learned in library school.

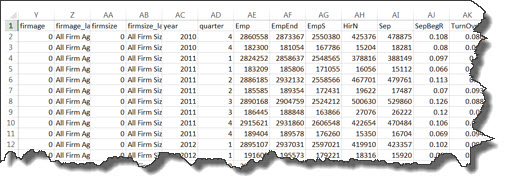

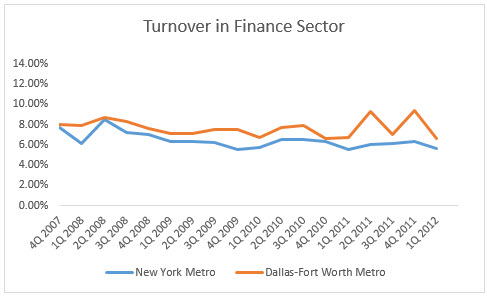

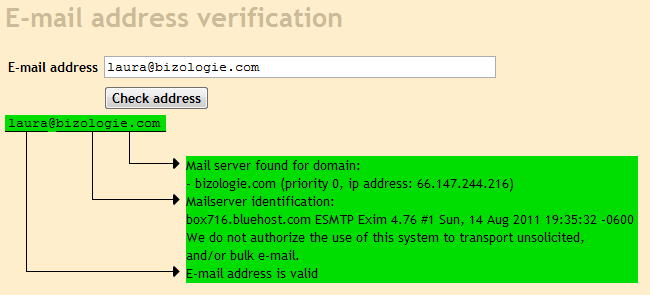

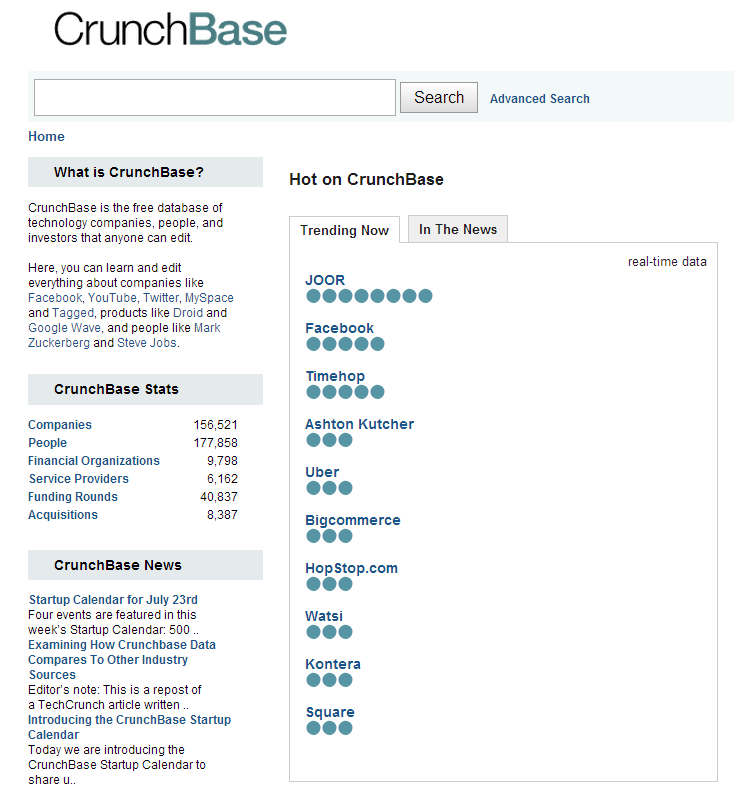

The inquiries run the gamut, from the typical “tell me how big this market is” and “tell me as much about this company as you can” types of queries to personal background checks, searches for CEO e-mail addresses, competitive landscape overviews, news runs, patent searches, trading comparables, acquisition comparables, demographic information, funding data and growth projections–all of them deadline-driven and highly confidential. It goes without saying that you wear many hats in a job like this, but the underlying goal is the same: to deliver a successful customer service interaction to our particular group of users, the investment professionals.

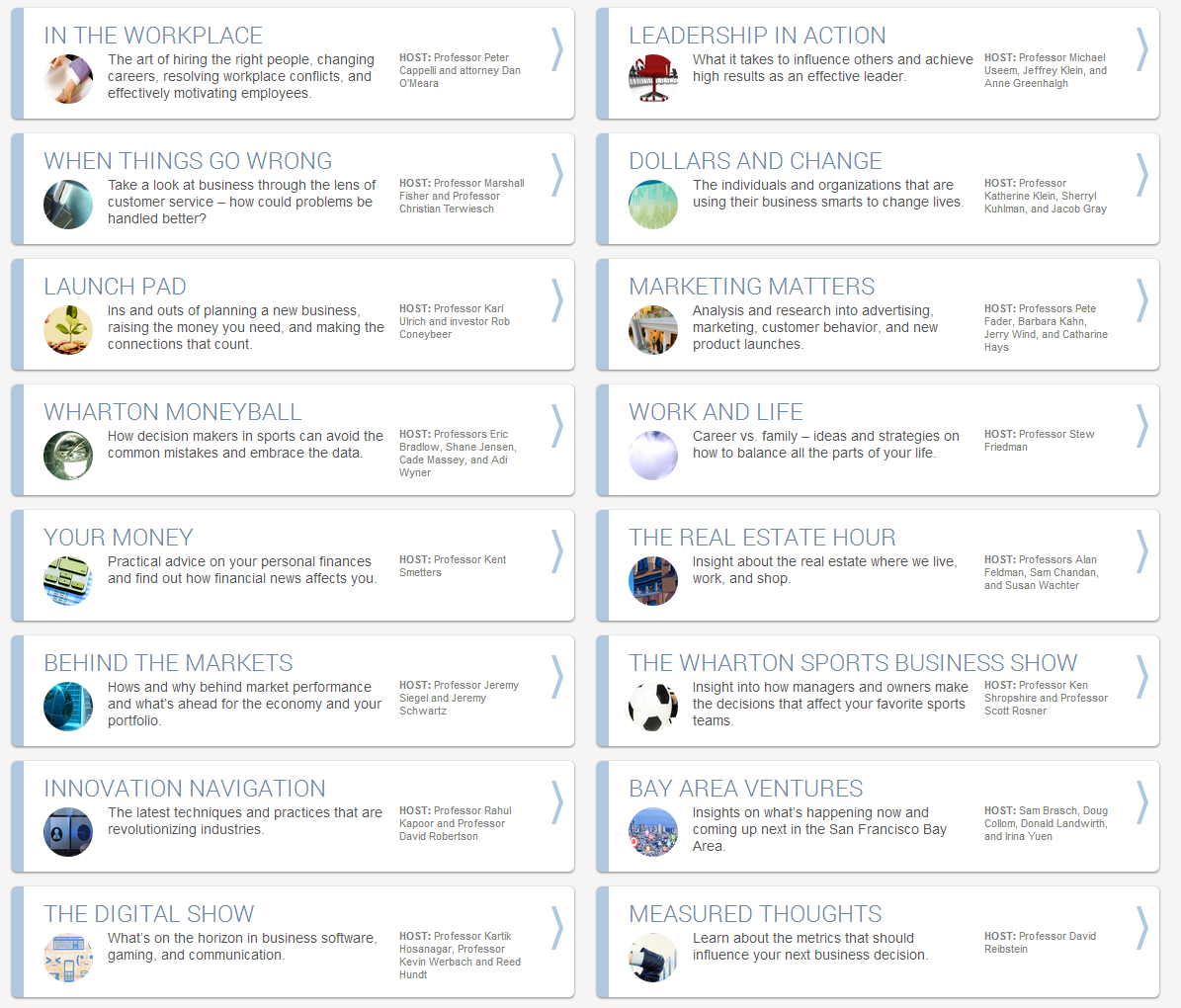

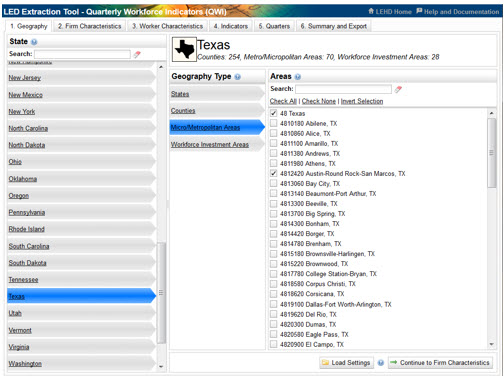

To facilitate our research, we use a number of proprietary databases, including the following:

- Financial data and analytics providers like Capital IQ and Thomson One;

- Equity research portals such as TheMarkets.com (recently acquired by Capital IQ);

- Independent research providers, including IDC, Frost & Sullivan and eMarketer; and

- News sources such as The Wall Street Journal, Factiva and the business journals.

We also rely on specialized services like Morningstar Document Research and Guidestar, financial- and technology-specific news sources such as TheDeal.com and GigaOM, legal research services like Westlaw and PACER, federal government databases (including American FactFinder and the Bureau of Labor Statistics), and publicly available search engines like Google and Bing. We occasionally reference print publications along the lines of Venture Capital Journal and Private Equity Analyst, but 98 percent or more of our research is conducted on the Internet.

Reverse Engineering

That said, it’s not always simply a matter of fielding an inquiry, performing a search, and then delivering the answer. On a daily basis, we encounter any number of challenges and obstacles that require us to lean on the skills we’ve accumulated during our careers as research professionals. Chief among these is the fact that sometimes the information a person is seeking simply does not exist, at least not in the form he or she desires–or perhaps it does, but only as part of a report that costs somewhere in the five-figure range and isn’t important enough in the grand scheme of things to purchase.

While obstacles like these can be frustrating, they can also inspire the development and implementation of creative search strategies that can sometimes lead us to a piece of proprietary research hidden in the “deep Web” or to an alternative data point that can be manipulated to reveal the answer a user is seeking. The ability to “reverse engineer” is an extremely valuable (if difficult to articulate) skill to have in a job like this one, as is the ability to recognize patterns, especially when we’re trying to piece together the storyline of a particular company or deal.

Reverse engineering, for instance, can come into play if we’re searching for information about a private company and finding little of substance. By examining the company’s business registration or taking a look at the WHOIS record for its URL, we can sometimes identify either the company’s former name or actual name, which often occurs when a firm is using a public-facing moniker named for a flagship product. This approach can also identify principals associated with the company and, in turn, supply us with a bunch of new search keywords. From there, it’s a matter of harvesting information and working back toward the present to provide context around “who” the company is and how and why and with whom it does what it does now.

If we’ve been charged with unearthing the details of the acquisition of a company by either a private equity firm or a corporation, looking for patterns or interesting coincidences can help us find the answer or at least obtain enough information about the transaction to make some solid inferences about it. For example, if the deal is not showing up in the standard financial databases, it’s possible the acquisition was part of a “roll-up,” a practice whereby a private equity firm buys multiple companies in the same industry and “rolls” them up together into a single, larger company. These transactions are sometimes hidden from view, especially when a recently-acquired company makes an acquisition of its own, a transaction that has undoubtedly been funded by its new parent company.

Armed with what we know of other similarly timed acquisitions, we might notice that the LinkedIn profiles of employees of a known-to-be-acquired company show them to be working simultaneously for both that entity and the company whose acquisition details we’re seeking. It’s also possible that we might discover separate news stories about both companies and their plans to relocate their headquarters to the same city. Our research might even lead us to other companies that appear as though they could be involved in the same roll-up, providing us with information that allows us to draw some reasonable conclusions about the acquisition of the company we were researching in the first place.

Of course, there is tedium in this job as well. For example, filling in the cells on a giant spreadsheet to build out a market map or contact matrix is probably not at the top of anyone’s list of good times. Like the more engaging assignments, however, it is something that needs to be done to contribute to the firm’s mission and, hopefully, its continued success.

Looking back on my days as an MLIS student, I can’t say it ever occurred to me to put my new and developing skills to work in the financial industry. Back then, I was on track to be a news librarian, which felt like a sensible path for me given my prior experience as a journalist. A chance meeting opened up a whole new world of possibilities and provided me with a new context in which to apply a set of skills I’d been developing. It’s a venture that has proven successful and reinforced the notion that a background in library and information science can indeed give an individual the professional capital he or she needs to get a “leg up” in the business world.

REFERENCES

National Venture Capital Association. 2012. FAQ: Frequently Asked Questions about Venture Capital. Arlington, Va.: NVCA.

_____. 2011. Venture Impact: The Economic Importance of Venture Capital-Backed Companies to the U.S. Economy. Arlington, Va.: NVCA.

This article was originally published in the December 2012 issue of Information Outlook.